HULK THINK NIMBYS ARE THE LUDDITES OF THE 21ST CENTURY. HULK SAY WEALTH COME FROM INCREASING ABUNDANCE, NOT FROM PRESERVING SCARCITY

— ECONOMIST HULK (@ECONOMISTHULK) March 28, 2013

@generalboles HULK FEEL MOST IMPORTANT POLICY TO ENCOURAGE GREATER DENSITY ON ALREADY DEVELOPED LAND. DENSITY GOOD FOR ECONOMY.I fully agree with Hulk's analysis, which goes to the heart of the housing crisis, not to mention the wider issues of macroeconomic volatility, wealth inequality and social mobility. The fundamental problem, I think, is that today's housing market is characterised by a spatial coincidence of elastic demand and inelastic supply. In other words, the places where we most need to build homes are often the places where people are least inclined to allow it.

— ECONOMIST HULK (@ECONOMISTHULK) March 29, 2013

It wasn't always this way. Elastic demand for housing means that as incomes grow at a certain rate housing demand grows even faster, but in decades gone by much of this demand could be met by expanding cities outward. This urban expansion and deconcentration was facilitated by huge improvements in the speed, cost and availability of transport technologies, from the tram to the train to the bike to the car.

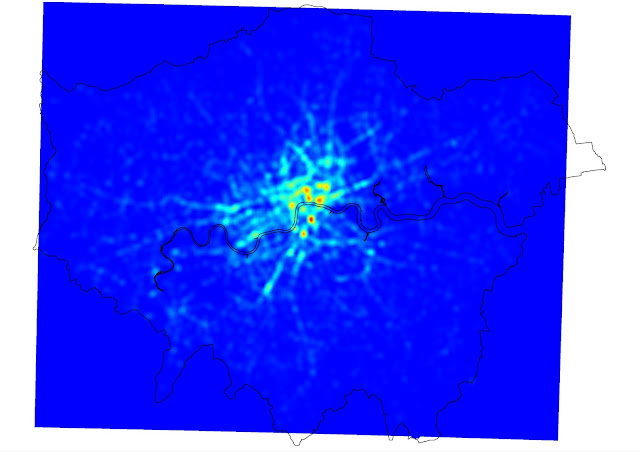

But in the past couple of decades urban deconcentration in many of the richer parts of the world has slowed or gone into reverse, partly because we've stopped coming up with amazing new transport technologies and partly because shifts in economic geography mean that jobs have returned to city centres. In London, for example, population and incomes are growing faster in Inner London than in the suburbs, after almost two centuries of deconcentration.

This is a big problem for housing supply, because it is much easier to build in places where nobody lives than to redevelop existing areas at higher densities. But as Hulk says above, that's exactly what we need to do if we are going to meet housing demand.

One of the reasons it is so hard to redevelop existing residential areas is that we have allowed the existing property owners to effectively veto new development which they feel is not in their interests. And they use this veto a lot. Not uncoincidentally, this happens to enrich them if they are home owners. Hulk again:

HULK THINK HOUSING SUPPLY INELASTICITY IN AREAS WITH HIGH PRODUCTIVITY GROWTH LEAD TO HUGE RENT-EXTRACTION BY EXISTING PROPERTY OWNERSOverall, restricting new housing supply in existing residential areas of high demand is bad for the economy (because it puts a brake on jobs growth and agglommeration effects), bad for the environment (because it forces people to make longer commutes), bad for social mobility (because it limits access to housing to those whose parents owned property in valuable areas) and bad for equality (because it exacerbates wealth inequality). But it's good for wealthy homeowners, so you can see the dilemma.

— ECONOMIST HULK (@ECONOMISTHULK) March 29, 2013

In future posts I'll look at whether and how we can moderate over-consumption of housing demand by the rich and improve housing supply. But for now, make sure you follow the Hulk.